Outgoing Education Secretary Betsy DeVos presented a spirited defense of her record after four years and skewered proposals from progressive politicians related to student debt cancellation and free college at the virtual 2020 Federal Student Aid (FSA) Training Conference on Tuesday.

“After nearly four years on the job, I want to take a few moments to reflect on the remarkable transformations that we led at FSA in recent years,” DeVos said at the beginning of the keynote speech, “and then discuss what still needs to be done for students.”

‘A socialist takeover of higher education’

DeVos took aim at proposals to cancel student debt, a proposal that the incoming Biden administration campaigned on, calling debt forgiveness “the truly insidious notion of government gift giving.”

“We’ve heard shrill calls to ‘cancel,’ to ‘forgive,’ to ‘make it all free,’” Devos added. “Any innocuous label out there can’t obfuscate what it really is: wrong.”

She also condemned the Democrat-supported idea of providing free college to lower-income Americans, calling the proposal “a socialist takeover of higher education.”

“Now, depending on your personal politics, some of you might not find that notion as scary as I do,” DeVos said. “But mark my words: None of you would like the way it will work.”

The way the government has handled student loans was a case in point, she argued.

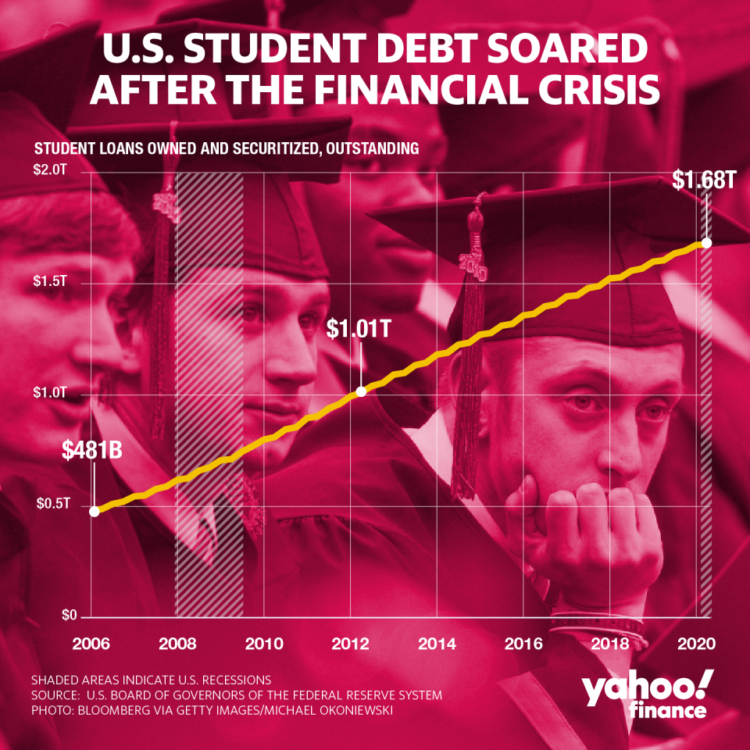

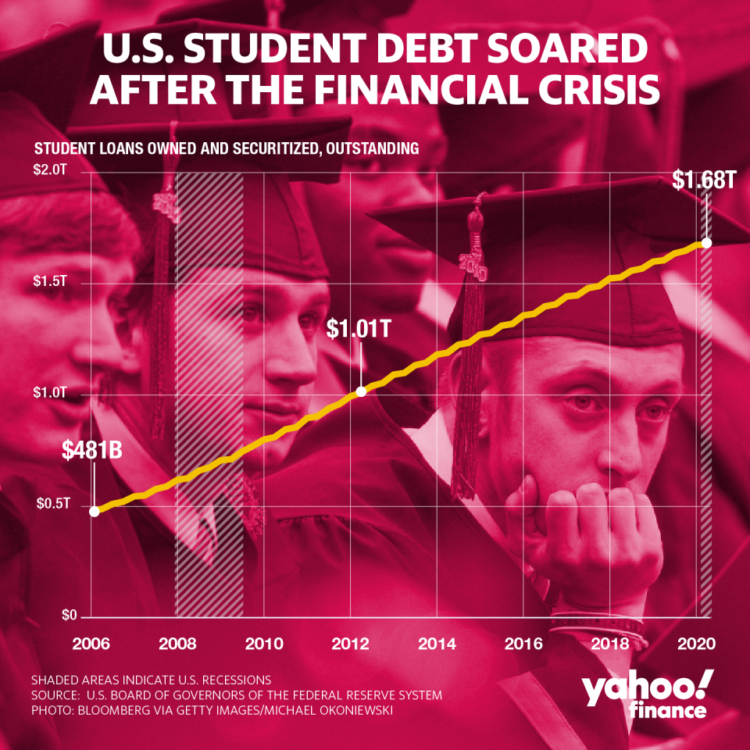

“The first step was monopolizing student lending,” DeVos said. “$1.5 trillion later, can anyone say with a straight face that students are better off? That taxpayers are better off?”

Making college free would water down the quality of American higher ed, DeVos claimed, adding: “If the politicians proposing ‘free college’ today get their way, just watch our colleges and universities begin to resemble a failing K-12 school, with the customer service of the DMV to boot.”

DeVos also asserted that it would be “fundamentally unfair to ask two-thirds of Americans who don’t go to college to pay the bills for the mere one-third who do. And it’s even more unfair to those who have held up their end of the bargain and paid back their student loans themselves to subsidize those who don’t save, plan, and pay.”

Instead, she proposed making FSA, which holds the trillion-dollar loan portfolio, a standalone government agency with its own Board of Governors.

“Today, FSA has more than $1.5 trillion in outstanding loans on the books,” DeVos noted. “Too many of those loans are either delinquent, in default, or are loans on which borrowers are paying so little [that] their loan balance continues to grow.”

‘It was a deeply inappropriate speech’

Reaction to her speech was both swift and sharp.

“It was a deeply inappropriate speech to be given at an apolitical training conference,” Eddy Conroy, associate director of institutional transformation at Temple University’s Hope Center College, Community, and Justice, told Yahoo Finance. “It was a nakedly political speech which is very on brand for Betsy DeVos…. [and] it also frankly feels very anti-higher education.”

Devos’ comments on forgiveness being “insidious” was also concerning, Conroy added: “I kind of am sort of gobsmacked by that. …. Fundamentally, this was a Secretary of Education who didn’t feel like students deserved much support of all. And this is just an extension of that general feeling.”

Betsy Mayotte, president of the Institute of Student Loan Advisors, told Yahoo Finance that the comments “show a real lack of understanding of what the average college student looks like and on the issue of the cost of higher education. It appears she has not spent her time as secretary studying the data and the issues but has instead chosen to hang her hat on partisan policy one liners.”

Mayotte added that to say loan forgiveness is not fair to those who paid off their loans is also a misunderstanding, as that is “assuming that the playing field is equal to begin with.”

Amid the largely political speech, DeVos mentioned one topic that everyone seems to agree on right now: The cost of higher education is becoming out of control.

“Institutions must also take a long look in the mirror,” DeVos said. “The higher education industry needs to deliver products that are worth the price tag.”

TECHNOLOGY12 months ago

TECHNOLOGY12 months ago

FINANCE11 months ago

FINANCE11 months ago

LIFE12 months ago

LIFE12 months ago

LIFE11 months ago

LIFE11 months ago

NEWS11 months ago

NEWS11 months ago

FINANCE11 months ago

FINANCE11 months ago

FINANCE11 months ago

FINANCE11 months ago

WAR11 months ago

WAR11 months ago